We have hit a century! Thank you for reading us.

This newsletter is really a public policy thought-letter. While excellent newsletters on specific themes within public policy already exist, this thought-letter is about frameworks, mental models, and key ideas that will hopefully help you think about any public policy problem in imaginative ways. It seeks to answer just one question: how do I think about a particular public policy problem/solution?

PS: If you enjoy listening instead of reading, we have this edition available as an audio narration on all podcasting platforms courtesy the good folks at Ad-Auris.

PolicyWTF: Prohibition and Morality

This section looks at egregious public policies. Policies that make you go: WTF, Did that really happen?

— Pranay Kotasthane

If one were to write a book chronicling bans on victimless crimes in India, the index entry for Morarji Desai would be a long one. After all, he holds the dubious distinction of turning lakhs of ordinary citizens into criminals by prohibiting two independent victimless crimes.

The first ban, on alcohol, is rather well-known. The notorious Bombay Prohibition Act of 1949 was passed when Desai was the state’s Home Minister. To enforce the ban, the government created elaborate compliance machinery, misdirecting the limited policing capacity towards apprehending tipplers instead of protecting victims of other crimes. By the time this act was watered down in 1964, more than four lakh people had been convicted under Prohibition! The draconian law is well-documented in Rohit De’s excellent book The People’s Constitution. Read this, for instance:

“The BPA granted vast powers to the police and Prohibition officers. It empowered Prohibition officers and all police officers to “enter at any time, by day or by night, any warehouse, shop, house, building, vessel, vehicle, or enclosed place in which [they have] reason to believe [that] intoxicants or utensils, apparatus or implements used for manufacturing intoxicants are kept.” They could also open packages and confiscate goods that they suspected of containing illicit liquor. Warrants were not required for arrests for any of these offenses or for searching premises. The BPA provided that people believed to have committed an offense under the act could be detained without trial and have their movements restricted. The Prohibition policy thus created a system that operated outside the penal code and the criminal procedure code that applied to most offenses.” [The People’s Constitution, Rohit De, page 45]

The direct consequences of this PolicyWTF aren’t hard to anticipate. People either switched to alternatives that bypassed the law or started consuming a far worse quality of alcohol in the black market. For instance, De writes:

By 1963 the Planning Commission was protesting the number of tinctures available in India. It pointed out that the British Pharmacopeia had reduced the number of tinctures from thirty-four in 1932 to fourteen in 1963, but the Indian Pharmacopeia of 1955 listed forty-two different tinctures. After interviewing leading medical representatives, the Planning Commission came to the conclusion that there was hardly any medical use of tinctures, which were outmoded and being replaced by modern drugs that were not alcohol-based. Spot checks revealed that several tinctures on the market were actually spurious, consisting solely of alcohol and a suitable coloring agent. Other manufacturers were producing eardrops and eyedrops with a large percentage of alcohol. The frustrated Planning Commission suggested that tinctures be abandoned for more modern medicine and that industrially produced eyedrops and eardrops be replaced by prescriptions that could be made by pharmacists. [The People’s Constitution, Rohit De, page 61]

Says a lot about central planning. When there’s demand, supply finds a way out in imaginative ways that governments can’t clamp down easily.

Desai’s second prohibition was on the sale and holding of gold, even in small quantities. It was this policyWTF that made smuggling of gold a lucrative profession. Here’s what the Directorate of Revenue Intelligence — a union government agency — observed in its Smuggling in India Report 2019-20:

The economic reforms of 1990s witnessed the repeal of the Gold (Control) Act, 1968 that had prohibited the import of gold except for jewellery. The erstwhile statute had led to the emergence of a notorious network of gold smugglers during 1970s and 1980s. The economic reforms and liberalisation led to the imposition of a modest specific duty of Rs 300 on 10 grams in 2011-12 (increased from Rs 200 in 2010-11) on the imported yellow metal, bringing gold smuggling almost to a grinding halt.

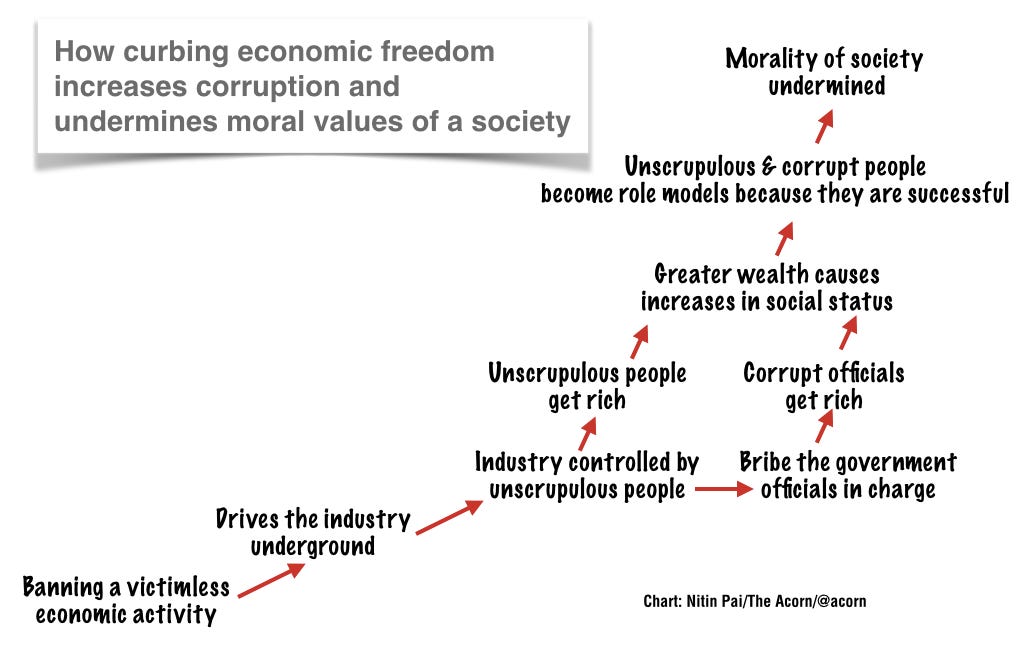

While both these policies had immediate adverse consequences, the general equilibrium effect was far worse: the successful and respected people in the society were the ones whose only competence was breaking the law.

PS: Nitin Pai, on his blog, succinctly captures the general equilibrium effects of banning victimless crimes in this figure.

Global Policy Watch: Student Loan Forgiveness and Friedman

- RSJ

The new Biden administration is expected to enact a student loan relief programme through legislation or an executive order when it assumes office later this month. There might even be a more comprehensive student loan reform on its agenda. The left-wing of the Democratic Party has made a case for a total student loan forgiveness for a long time now. Biden is a centrist, yet he might use the student loan relief proposal as a bargaining chip to rein in other more socialist ideas from them. It will be interesting to see if the administration merely forgives a part of the outstanding loan or it uses the student loan crisis to arrive at a more market-driven long-term solution to the problem of funding higher education and the role of government in education in general.

Quantum Of Crisis

There are about 45 million student loan borrowers who owed roughly USD 1.6 trillion in 2019. To put that in perspective, India’s total credit outstanding is in the same ballpark. On average, each borrower has over USD 34,000 outstanding credit. By some estimates, the Biden forgiveness proposal is to waive off USD 10,000 from this. That would mean a total waiver of about USD 500 billion. No small change even in the days where stimulus packages routinely run into trillions.

So, what explains these eye-popping numbers that are unique to the US education system?

Well, there are a few reasons.

Because the colleges can: There has been no disruption in the higher education model over the past two hundred years. The system is an oligopoly. The same set of universities have remained at the top through a combination of brand building, (alumni) network benefits and bigger endowments (that are tax-free). The price set at the top is high and everyone below the chain benchmarks to that price. As income inequality has grown, the price has gotten unaffordable at every level except the very top.

Student loans are expensive by design: There’s hardly any collateral to hold as security for a student who is getting started in life. These loans are largely unsecured, unlike a mortgage where the house is the underlying security for the banks. The possibility of a student getting a good job and paying back the loan is relatively lower than most other loan types. Added to this is the uncertainty about the final location of the student after he finishes off his education and the costs of tracking them down. It is no surprise the default rates of these loans are in excess of 10 per cent. These uncertainties are baked into the pricing of a student loan. They tend to be long-term and expensive.

Universities have no incentive to innovate: Why should they? They control their supply and keep college seats ‘scarce’. The admission rates of Ivy league schools have been coming down over the years. They are at sub-five per cent these days. This scarcity gives them enormous pricing power. They offer lifelong tenures to the professors. There’s hardly anyone who holds a university to account for failed careers of its students. The student cops most of the blame. It is a great business model with limited accountability. Here’s a sample statistic. Students at public four-year institutions paid an average of $3,190 in tuition fee for the 1987-1988 school year, with prices adjusted to reflect 2017 dollars. Thirty years later, that average has risen to $9,970 for the 2017-2018 school year. That’s over 200 per cent increase after adjusting for inflation. The entry-level salaries haven’t kept pace with that. After adjusting for inflation, they are almost flat over this time.

This is what riles the ‘progressives’. The higher education system now perpetuates inequalities instead of reducing them. The system is rigged from the start - SAT scores track family income closely, private counsellors help kids from rich families to write their applications and expensive tuitions in drama, music or elite sports help in making the cut. The list of such privileges that are needed to get in is long. And the higher education system explains all of this away in the name of merit.

The Moral Burden Of Student Debt

Those who battle this entrenched system and take expensive loans to fund themselves can find the going tough. The job market remains choppy, the nature of jobs is changing and there’s increasing automation in every sector. To start your career with a debt that you can’t be sure of paying off is a burden that seems unjust. Worse, there are many others who can’t get a loan or don’t venture into higher education at all because the costs are high. It is a terrible loss of human potential.

This much is commonly understood. The problem is with the solution that the ‘progressives’ advocate - a kind of a universal free higher education model best captured by Bernie Sanders line “College For All and Cancel All Student Debt”:

Today, we say to our young people that we want you to get the best education that you can, regardless of the income of your family. Good jobs require a good education. That is why we are going to make public colleges and universities tuition free, and cancel all student debt.

The problems with such prescriptions are aplenty. We have devoted multiple newsletters to them. When the price is zero, supply tends to zero. The inherent moral hazard of cancelling debts. What about those who actually paid their debts? What about those who didn’t take up college because they didn’t want to take debt? What about other borrowers who took other types of loans? Why should their debts be not cancelled? This a terrain full of moral hazard landmines.

Government, Market and Education

So how should we think about solving this? To start with we need to understand the market failures in the education system. What are they?

Primary and secondary education has positive externalities. There’s a benefit that accrues to the society in educating one person which can’t be captured by the supplier. This restricts the supply of such goods because they can’t be priced accurately. The government has a role in addressing this failure through subsidies or vouchers. Higher education or vocational training are tailored to provide employment to an individual. The positive externalities here are overshadowed by the private economic benefits to an individual. So higher education doesn’t have this type of market failure

But it has other failures. One is the information asymmetry problem. You can never know how good a college is till after you finish college and enter the job market. The college and your goals aren’t exactly aligned. There’s no downside risk to the college if you don’t get the right kind of job after it. This asymmetry problem extends to the banks providing student loans. They don’t have enough information about either the student or the quality of college education to assess the risk of future payments. They err on the side of caution.

The interesting thing is there’s a 65-year old paper authored by Milton Friedman that captures the role of the government in education. The 1965 paper ‘The Role of Government in Education’ is a document of remarkable clarity and vision even by Friedman standards. It is not a dogmatic advancement of the market as a solution to the problem of funding education. It is nuanced and deeply insightful about what the government should be doing in education.

Friedman On Government In Education

I will end with two key excerpts from it. First, Friedman’s views on primary and secondary education and the role of the government in it. His solution was simple - public financing but private operations of education in this space:

“The arrangement that perhaps comes closest to being justified by these considerations--at least for primary and secondary education--is a mixed one under which governments would continue to administer some schools but parents who chose to send their children to other schools would be paid a sum equal to the estimated cost of educating a child in a government school, provided that at least this sum was spent on education in an approved school.

This arrangement would meet the valid features of the "natural monopoly" argument, while at the same time it would permit competition to develop where it could. It would meet the just complaints of parents that if they send their children to private nonsubsidized schools they are required to pay twice for education--once in the form of general taxes and once directly--and in this way stimulate the development and improvement of such schools. The interjection of competition would do much to promote a healthy variety of schools. It would do much, also, to introduce flexibility into school systems. Not least of its benefits would be to make the salaries of school teachers responsive to market forces. It would thereby give governmental educational authorities an independent standard against which to judge salary scales and promote a more rapid adjustment to changes in conditions of demand or supply. “

The second excerpt is about how to think of funding higher education or vocational programmes taken to improve employment prospects. Friedman suggests an Income Share Agreement (ISA) model all those years ago.

“For vocational education, the government, this time however the central government, might likewise deal directly with the individual seeking such education. If it did so, it would make funds available to him to finance his education, not as a subsidy but as "equity" capital.

In return, he would obligate himself to pay the state a specified fraction of his earnings above some minimum, the fraction and minimum being determined to make the program self-financing. Such a program would eliminate existing imperfections in the capital market and so widen the opportunity of individuals to make productive investments in themselves while at the same time assuring that the costs are borne by those who benefit most directly rather than by the population at large. An alternative, and a highly desirable one if it is feasible, is to stimulate private arrangements directed toward the same end.”

It is instructive to conclude here with Friedman’s conclusions from the paper:

“This re-examination of the role of government in education suggests that the growth of governmental responsibility in this area has been unbalanced. Government has appropriately financed general education for citizenship, but in the process it has been led also to administer most of the schools that provide such education. Yet, as we have seen, the administration of schools is neither required by the financing of education, nor justifiable in its own right in a predominantly free enterprise society. Government has appropriately been concerned with widening the opportunity of young men and women to get professional and technical training, but it has sought to further this objective by the inappropriate means of subsidizing such education, largely in the form of making it available free or at a low price at governmentally operated schools.

The lack of balance in governmental activity reflects primarily the failure to separate sharply the question what activities it is appropriate for government to finance from the question what activities it is appropriate for government to administer (emphasis ours)--a distinction that is important in other areas of government activity as well. Because the financing of general education by government is widely accepted, the provision of general education directly by govern mental bodies has also been accepted. But institutions that provide general education are especially well suited also to provide some kinds of vocational and professional education, so the acceptance of direct government provision of general education has led to the direct provision of vocational education. To complete the circle, the provision of vocational education has, in turn, meant that it too was financed by government, since financing has been predominantly of educational institutions not of particular kinds of educational services.”

A Framework a Week: A Taxing Month Ahead

Tools for thinking public policy

— Pranay Kotasthane

What’s a budget without new taxes, fees, cesses, or surcharges? As the budget date nears, let’s understand the categorical differences between these four seemingly interchangeable terms.

A tax is the purest economic manifestation of the state’s monopoly over the legitimate use of force within its territory. That’s because a tax is not accompanied by the promise of any specific service by the government in return. The money raised from taxes goes into the consolidated fund of the relevant level of government. Then on, it’s the government’s prerogative to decide what this money should be spent on. So if you were to file a case refusing to pay income and property taxes on the grounds that the road outside your house is broken, you would’ve no chances of winning the case.

A fee, in contrast, involves a quid pro quo. You pay for a service or good in return. When you pay a parking fee, you pay for the right to occupy a physical space for a specific period of time. The linkage between what you pay and what you get in return is much clearer than is the case with taxes. It is for this reason that collecting fees for private services is a less distortionary way of raising resources for local governments. We had covered this in more detail here.

A cess is tied to an earmarked purpose. The money raised through a tax is held separately to fund a project that the cess is meant for. A Swachch Bharat Cess, for example, is a levy on services, the proceeds of which are used to fund the Swachch Bharat Abhiyaan. If you filed your income tax returns, you would have also noticed a health and education cess of 4 per cent. A legitimate question is that if this cess is being used to finance something as core as health and education, what were the taxes you pay being used for in the first place.

Through some legal chicanery, the government has another advantage of raising money through the cess route. This money doesn’t fall in the divisible pool that needs to be shared with other levels of government. Unsurprisingly, the union government has been raising cesses to subvert the Finance Commission’s recommendation of devolving a larger chunk of the divisible pool of money to state governments.

Surcharges are eviler. They are merely taxes on taxes. They are not raised for an earmarked purpose. Neither are the proceeds shared with lower levels of government.

So that’s that. There are many ways in which governments can extract money from you, some better some worse.

For more, read:

Cesses and Surcharges: Concept, Practice and Reform, A Fifteenth Finance Commission Study conducted by Vidhi Centre for Legal Policy

Matsyanyaaya: Decoupling Dynamics

Big fish eating small fish = Foreign Policy in action

— Pranay Kotasthane

A lot has been written about businesses moving away from China as a fallout of geopolitical tensions with the US. Fewer write-ups have tried to imagine what this decoupling would actually look like. A recently released report by the European Union Chamber of Commerce in China & MERICS does a good job of analysing this process.

The report breaks down decoupling into nine layers in four major categories:

Macro decoupling – political and financial;

Trade decoupling – supply chains and critical inputs;

Innovation decoupling – research and development (R&D), and standards; and

Digital decoupling – data governance, network equipment and telecommunications services

Of these, the authors identify three layers of high concern — decoupling of critical inputs such as semiconductors, software, and rare earths, decoupling of data governance regimes, and decoupling of standards. In contrast, financial decoupling is less likely because of China’s inability to internationalise renminbi and its continued dependence on the US dollar even for its Belt and Road projects.

In short, the US-China confrontation is likely to play out over critical and emerging technology and not over finance and industrial production.

Finally, there’s a useful framework visualising how decoupling across the nine layers might look in three scenarios.

HomeWork

Reading and listening recommendations on public policy matters

[Book Excerpt] Toppling the myth of meritocracy: Excerpt from Michael Sandel’s “Tyranny of Merit: What’s Become of the Common Good?”

[Article] Robert Farrington writing in the Forbes: “The Moral Hazard Of Student Loan Forgiveness”

[Article] Prohibition’s ghosts continue to linger in Mumbai, writes Shoaib Daniyal.

Share this post