India Policy Watch: Crypto And Samvidhaan

Insights on burning policy issues in India

— RSJ

When you write a weekly newsletter you view every news item as possible content for the next edition. You shoehorn some framework or stretch things to draw a historical parallel with that event. Trust me, it can be tiring - speaking for me, not for Pranay who has frameworks for his breakfast with poha. But as I sometimes like to say, there are weeks when content presents itself on a platter with a side of masala papad. This is one of those weeks.

First, there was news that the government plans to table the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, in the winter session of the Parliament. It is likely the government will impose strict regulations that might fall short of an outright ban on them. Separately, there are indications that the bill will have a framework for creating a digital Rupee to be issued by RBI, the equivalent of a central bank digital currency (CBDC). We have written about crypto and CBDC in previous editions (here and here) through the lens of public policy and economics. As Satoshi wrote in his essay:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

That digital currencies will reduce transaction costs, be more efficient as a payment method, and can have all kinds of interesting decentralisation use cases, is all good. But as the past year in India has shown, nobody thinks of cryptocurrency as a medium of exchange. It has turned into a speculative asset with customers being promised outrageous returns in ads that are everywhere. This has meant hordes of unsuspecting investors flocking to crypto exchanges with estimates of crypto owners in India ranging from 10 to 100 million. The number of cryptocurrencies globally has shot up too and it’s a bit difficult to make out what’s a meme and what’s real anymore in this world. Consumer protection is a real issue now. The decentralised and anonymous nature of transactions is a further worry for the RBI and government. There are concerns around the use of crypto to fund criminal activities or for money laundering.

But most importantly, for central banks and governments, letting private cryptocurrencies go unchecked and unregulated will gradually take away their power to influence monetary policy. This is a difficult thing to let go because a fundamental principle on which the modern economy rests is that the governments (or central banks) know what to do about the supply of money in general interest. Of course, the votaries of crypto and decentralisation believe this isn’t true. They would go back to the argument Hayek had made in his book Denationalization of Money:

“A single monopolistic governmental agency can neither possess the information that should govern the supply of money nor would it, if it knew what it ought to do in the general interest, usually be in a position to act in that manner. Indeed, if, as I am convinced, the main advantage of the market order is that prices will convey to the acting individuals the relevant information, only the constant observation of the course of current prices of particular commodities can provide information on the direction in which more or less money ought to be spent. Money is not a tool of policy that can achieve particular foreseeable results by control of its quantity. But it should be part of the self-steering mechanism by which individuals are constantly induced to adjust their activities to circumstances on which they have information only through the abstract signals of prices. It should be a serviceable link in the process that communicates the effects of events never wholly known to anybody and that is required to maintain an order in which the plans of participating persons match.”

This battle between the centralisation instincts on which the edifice of the state rests and the promise of decentralisation and individual control that Web3 or Metaverse, or whatever else they are calling it now, offers, is going to define this century.

Second, I noticed there were some enthusiastic celebrations for Constitution Day on Nov 26 across India. Except at the Central Hall of the parliament. About 15 parties boycotted the function organized by the Lok Sabha Speaker because they felt the government was disrespecting the Constitution and undermining democracy. Not sure how staying away from an event that celebrates the Constitution helps. Anyway, the PM responded to the boycott by claiming dynastic parties are the biggest threat to the health of Indian democracy. Indeed! The LS Speaker compared the Constitution to the Bhagwad Geeta to mix things up further. The usual Twitter wars broke out on who had subverted democracy more over the years while others pulled out the original text of Constituent Assembly debates to show how far we have fallen in our discourse. All in a day in the life of India.

The Centre Cannot Hold But…

As I was reading through these, cryptocurrency and Constitution, and wondering if there was a way to bring them together for this edition of the newsletter, providence struck. The next news item was - ConstitutionDAO’s bold crypto bid for US Constitution falls short. Yes, Constitution and crypto in a single line. Someone up there must be looking out for me. Here’s more:

“There are 13 surviving copies of the original print of the U.S. Constitution. Today, a decentralized autonomous organization (DAO) announced it lost its bid to buy one from art dealer Sotheby’s after a high-stakes bidding war that captured the internet’s attention. Still, the bold ascendance of the DAO, a group of people who met on the internet, is a unique case study into the art of on-ramping swaths of people into crypto, one meme and auction at a time.

Austin Cain and Graham Novak, two 25-year-old Atlanta residents working in finance, first started a Discord chat to launch the effort, which now has more than 8,000 members. Within a week of launching, the DAO raised over $40 million worth of ETH on Juicebox, an early stage DAO platform.

The effort, largely spun up through Twitter and a ballooning Discord server, is a window into what a community effort could look and feel like in a Web3 universe, where shared ownership and transparency are guiding principles. The opportunities presented by the DAO structure are sparking widespread interest — the value governed by DAO treasuries is now at over $6 billion, per some estimates.”

So, a few people created a DAO to buy an original print of the US Constitution that was up for auction. ConstitutionDAO, as they called it. About 17,500 people raised about $50 million worth of ether (ETH), the native cryptocurrency of Ethereum using Juicebox, a platform that gets you started on setting up a DAO. But the process was a bit more complicated. Sotheby’s doesn’t accept cryptocurrency, nor does it recognise a DAO; it needs bids to be made by an individual or an organization in fiat currency (in this case Dollars). So, ConstitutionDAO set up a non-profit entity that could bid on its behalf. The next challenge was how to make sure all 17,500 members could claim to own a piece of the original print. This kind of fractionalised ownership is difficult to administer. So, the DAO arrived at a workaround. They would issue a ‘governance token’ called PEOPLE for donations made by contributors at the rate of 1 million PEOPLE per 1ETH donated. These PEOPLE tokens represented the voting rights of the members in the DAO for any decision to be taken. In this case, the voting right was restricted to what the DAO would do with the original imprint of the Constitution once they won the auction - where to display it and what to do with the proceeds etc. The whole thing sounded like the future had arrived. A decentralised group of “we, the people” on Discord decide to bid for the original copy of the US Constitution and beat the usual gaggle of billionaires who show up at auctions. People’s document would then be at the hands of people.

This is how it worked. A donor would buy ETH on a crypto exchange by paying dollars. The ETH would then be parked in a crypto wallet which would then pay Juicebox for redeeming PEOPLE token. Throughout this process, at every step, you would have to pay transaction fees for using the platforms. These are called ‘gas’ fees in the crypto world and they are fixed in nature regardless of the size of the transaction. As many articles have pointed out, the ‘gas’ fees for small value transactions could be as high as 30-40 per cent. Anyway, the ConstitutionDAO raised about $50 million in little under a week. Such was the buzz around PEOPLE token that a secondary market for trading of the token opened up.

All was going well till the DAO lost at the auction. It was outbid by billionaire Ken Griffin, founder of hedge fund Citadel, who is a known crypto sceptic. I mean if you publicly announce the total corpus you have raised for an auction and then let everyone know you’re going to underbid, your odds of winning will be quite low. I guess strategy isn’t a strength of DAOs. Of course, Griffin wasn’t impressed with this DAO business. As Bloomberg reported:

“I wish all this passion and energy that went to crypto was directed toward making the United States stronger,” Griffin told Bloomberg’s Erik Schatzker at the Economic Club of Chicago on Oct. 4. “Let’s face it — it’s a Jihadist call that we don’t believe in the dollar. I mean, what a crazy concept that is.”

Doubts Over DAO

Anyway, the lost bid raises all kinds of questions.

What do you do with a DAO that has no objective any longer? Disband it or choose another objective? Who decides? Or how if, like in this case, there are no governance tokens issued yet? Or, if they had, is it fine then to have those with more tokens having more votes than others? Should you return the money and let donors incur the ‘gas’ fees one more time? Is this a prototype for next generation ‘wire frauds’? If as simple a use case for DAO like this fails and raises so many questions, what about other ambitious plans? How difficult they might turn out to be?

The charitable view might be this shows it is possible to do something like this. That a group of people driven by a single purpose could come together in a short time and raise a large amount of capital. I’m sure that’s some achievement but I guess people raised more than $100 million back in 1985 for LiveAid to help out famine afflicted Sub Saharan Africa. Radically Networked Societies (RNS) because of their non-hierarchical structure can mobilise really quickly. But is speed so important a feature that it trumps everything else? Over the past few months, I have sat through multiple podcasts and read long-form articles that feature decentralisation evangelists like Balaji Srinivasan, Vitalik Buterin, or Naval Ravikant talking at length about the future of human civilisation. It is all about networked states, starting a country from scratch using your laptop, and using blockchain to make your lassi.

My reactions to these discussions have ranged from ‘what!’ to ‘Lolwut’. There’s some kind of ‘This is John Galt speaking’ vibe when I listen to them. That book, Atlas Shrugged, had pages and pages of soliloquies by characters declaiming about some kind of an ideal future. As an impressionable young man, I read them with great passion. Over the years I realised there’s no ideal future that can be built by upending the current. Human progress is incremental and gradual. We have an imagination of ourselves, our community and of our nation. It is tied to real and tangible artefacts, like our constitution, our books, our languages, our affiliations and an understanding of our civilisational story. Technology was always seen as an enabler for a comfortable life for us. It has delivered value to us beyond our wildest imagination in the past two centuries. Maybe for the first time in history, it is positioned to take control of our lives. And those leading it are keen to establish its benefits to hold the reins of humanity. I don’t know if it is a good idea. Regulating technology is the key policy challenge for the foreseeable future. It needs a more enlightened view of our civilisation than what the tech bros have to offer.

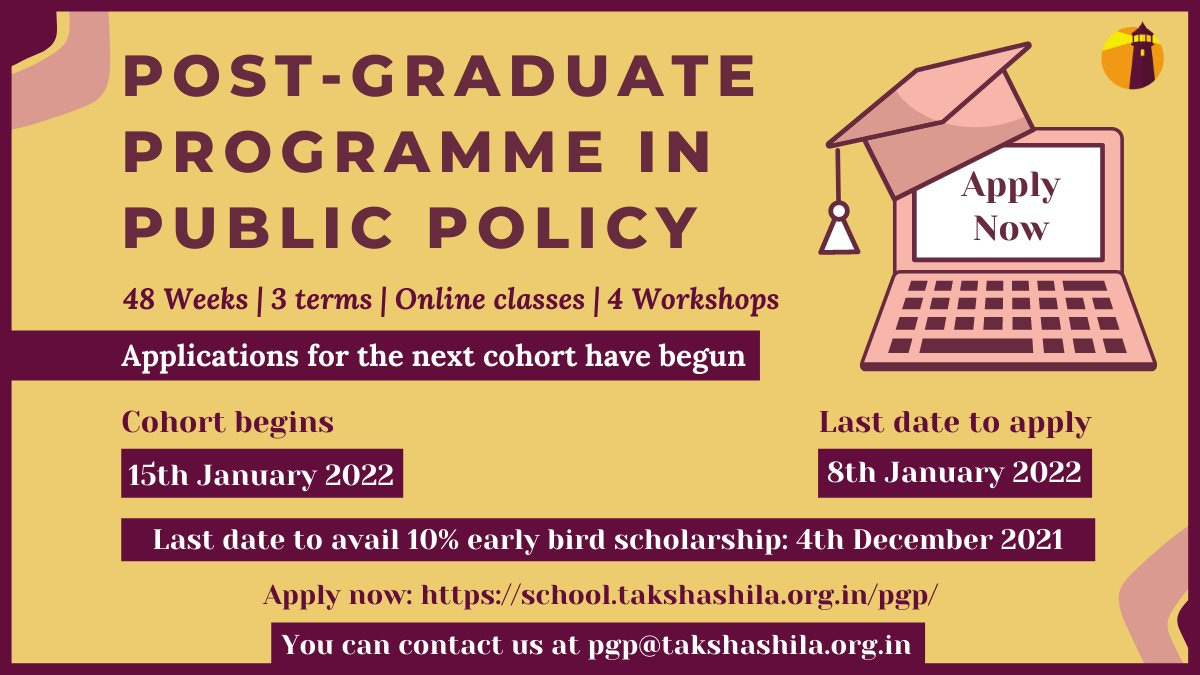

If you find the content here useful, consider taking a deep dive into the world of public policy. Takshashila’s PGP — a 48-week certificate course will allow you to learn public policy analysis from the best practitioners, academics, and teachers. And that too, while you continue to work. In other words, the opportunity costs are low and the benefits are life-changing. Do check out.

Matsyanyaaya: Pegging China’s Tech Power

Big fish eating small fish = Foreign Policy in action

— Pranay Kotasthane

If one were to judge the technological prowess of a nation-state on the basis of daily news, China comes across as heads and shoulders above the rest. Hardly any day passes by without reports reminding us that China is well on its path to creating a self-reliant technology industry.

While China’s technological progress is quite real, I want to list three caveats to make you recalibrate exponential growth projections and over-optimistic predictions about China’s tech ecosystem.

1. CCP’s self-preservation imperative

Across many critical sectors such as defence and technology, the CCP exaggerates its capabilities. This strategy is not meant to be just an information operation aimed at other nation-states. It is also a domestic imperative for the CCP, to create a perception that it has things under control at all times.

Projecting control requires demonstrating success. For this reason, CCP propaganda projects promising initiatives by individual companies as world-beating solutions. What we forget is that such reportage is prone to survivorship bias — it overlooks the many companies and initiatives that have failed.

Take the example of Tsinghua Unigroup — which made a lot of news in 2015 for its bid to buy the American memory chipmaker Micron. Once touted as China’s leading chip design house, it has since then failed to make any major breakthroughs. As of now, it is reeling under debt and the government is coordinating its buyout to another player. Similarly, companies such as the Wuhan Hongxin Semiconductor Project (HSMC), once projected to unleash China’s first seven-nanometer foundry went bust last year. But you’ll hardly see reports about the costs and consequences of such failures.

2. US’ Need to Align Domestic Vectors

The second reason why we should be wary of tall claims is that it is in the interest of the US military-industrial complex to overplay China’s technology capabilities. There are few things that can fire national imagination like a well-equipped, seemingly more advanced adversary.

Just as the Sputnik moment aligned the domestic constituencies in the US and resulted in path-breaking institutions such as the DARPA, overplaying China’s technological advances creates room for prioritising expenditure on key technologies and their governance structures.

It’s not surprising then that the first National Strategy for Critical & Emerging Technologies (C&ET) put out by the Trump administration explicitly cautions against China’s pursuit to become a global leader in Science & Technology.

As an example, consider the debate over semiconductor policy in the US. China’s shadow over East Asia has allowed the US semiconductor industry to make a persuasive case for higher incentives and government support.

3. Opportunity Cost Neglect

A lot of China’s technological success is being financed by governments at the city, provincial, and central levels. While the benefits and successes of these initiatives make news, the costs do not. And as a student of public policy, the first question that comes to my mind is: what is the opportunity cost of China’s governments pouring money, attention, and time into this quest for all-around self-reliance?

Predicting a linear growth path based on current trends misses asking the opportunity cost question completely. In my view, the odds of getting anywhere near the US’ technological capabilities are stacked against China for three reasons.

One, China’s per capita GDP is one-eighth of the US GDP per capita. Simply put, every dollar used in pursuit of one technology goal in China is eight times as costly as a dollar used for the same purpose in the US. With limited resources available, China might well be able to take a lead in a few areas but the opportunity costs are likely to catch up much before it reaches anywhere near self-reliance.

Two, until now, the opportunity costs were partially being borne by other countries, particularly the US. FDI from the US and uninhibited access for its citizens to the technology ecosystems of other countries allowed China to make rapid progress in key technology domains. That party is now over. The US is now acutely aware of the asymmetric advantage that China enjoyed in the old-world globalisation period. The US has already started putting in place restrictions on the movement of knowledge and capital to China. Under this changed geopolitical scenario, China’s technological superiority is far from inevitable.

Take the example of the recent Alibaba announcement of Yitian 710 - a cutting-edge server chip. The Taiwanese foundry TSMC is the only company that can mass-produce this chip. And there are already murmurs in the US to restrict TSMC from accepting orders from Alibaba on the grounds that this chip can potentially have military applications.

And three, the US still remains a vibrant destination attracting the best tech talent from across the world. Chinese governments can throw money but is unlikely to attract top global talent in the same manner. And in the high-tech domain, skilled labour holds the key.

And so, the next time you come across another technological breakthrough in China, take a deep breath and consider if any of the three factors outlined in this note modulates the hype.

India Policy Watch #2: Health Data Aayo Re

Insights on burning policy issues in India

— Pranay Kotasthane

The National Family Health Survey-5 results have been published. And you know what’s the best part? It’s that the National Family Health Survey-5 results have been published. No, really. The foundation of evidence-based public policy is reliable, high-frequency, population-scale information. In its absence, we have to settle for policy-based evidence making.

The NFHS-1 conducted in 1992-93 was funded by the United States Agency for International Development (USAID). The latest avatar was spread in two phases over two years due to the pandemic. Most importantly, it began three years after the NFHS-4 of 2015-16. Given that earlier versions had gaps of six, seven, and ten years between them, it is encouraging that this critical information is being collected at a higher frequency. I hope an NFHS every three years becomes a norm. The timely release of this data will prepare the ground for voters to judge their representatives, amongst other things, on public health outcomes. Such a feedback loop is completely missing in our current electoral cycle.

Now, to the results. In edition #133, I presented a list of phrases that should fall into disuse from our policy discourse. One of them was ‘population explosion/bomb’. The NFHS-5 results confirm, yet again, that India’s population is reducing across regions, religions, and income groups. In fact, the fertility rate is already below the replacement rate; India’s population has stabilised. This means we should stop letting our governments escape responsibility in the name of overpopulation. Also, government schemes to deny people services and rights on the basis of the number of children should be summarily rejected.

Next, the sex ratio at birth has improved from 919 to 929 since 2015-16. This number is still lower than what nature would dictate. Though the preference for sons in Indian society still remains strong, this data suggests a gradual shift away from this mindset.

The attention should now shift from overpopulation to real issues such as the increase in the prevalence of anaemia and obesity. The NFHS-5 results help in framing India’s health challenge accurately.

HomeWork

Reading and listening recommendations on public policy matters

[Article] Balaji Srinivasan: “A network state is a social network with a clear leader, an integrated cryptocurrency, a definite purpose, a sense of national consciousness, and a plan to crowdfund territory.” Go Figure.

[Article] Ashwini Deshpande has an excellent take on the NFHS-5 results.

[Book] Montek Singh Ahluwalia’s Backstage is a book filled with interesting nuggets about the pre-1991 economy. Enjoyable read.

Share this post