Global Policy Watch: Europe’s War

Global policy issues and their implication for India

— RSJ

There is an energy crisis in Europe. Russia announced this week that it won’t resume supplying gas to Europe via the Nord Stream 1 pipeline until the west lifts the sanctions over its invasion of Ukraine. Till last year, Russia accounted for about 45 percent of the EU's total gas imports. About a third of it flowed through Nord Stream 1. A few months back Russia halted supply via Nord Stream citing maintenance concerns. At least there was a pretense. Now the gloves are off. The weaponising of energy is complete. That apart you may have heard of this being the hottest summer in Europe in living memory. The rivers have run dry and hydel power generation is at an all-time low. The crisis is real.

How bad is it? Well, if you go by estimates an average European household might end up spending over €500/month by March next year on their energy bill. This number was around €160-170 /month a year back. This will mean an aggregated annual increase in energy spends in EU of about €2 tn. To put this in perspective, the total GDP of the member states is around €14 tn. No economy can take such a price surge in its stride, more so, when the inflation is already running at a multi-decadal high. Typically, they could do a few things to manage this. One option is to cap the prices of imported gas from Russia. The other is for the governments to absorb these price increases and lighten the burden for the people. The last option is to reduce demand by imposing rationing measures on people. The long term option is to move to renewables but that’s not going to help anyone during this winter.

The idea of capping imported gas prices seems the easiest. Of course, price caps distort markets and will lead to other unintended consequences but you have to choose the lesser devil in scenarios like these. Except any price cap on Russian gas will mean you will have to deal with the wrath of Putin. On Wednesday, he gave EU leaders a peek into how he sees any attempt by the EU to impose a price cap. As CNBC reported:

Responding to EU proposals to implement price caps on Russian energy imports, Putin told business leaders in Vladivostok that Russia could yet decide to rip up existing supply contracts.

“Will there be any political decisions that contradict the contracts? Yes, we just won’t fulfill them. We will not supply anything at all if it contradicts our interests,” Putin said at the Eastern Economic Forum in Russia’s far east.

“We will not supply gas, oil, coal, heating oil — we will not supply anything.”

“We would only have one thing left to do: as in the famous Russian fairy tale, we would let the wolf’s tail freeze. Freeze, freeze, the wolf's tail,” he said.

Hmm. So, what’s this famous Russian fairy tale about a tail? The good, ol’ Pravda came to the rescue here:

In the tale, the cunning fox made the stupid wolf catch fish in the frozen river by putting his tail into an ice hole. The fox would hop around the desperate and hungry wolf saying "freeze, freeze, the wolf's tail" until the ice hole froze trapping the wolf in the ice. Men from the village then came and beat the wolf for all the bad things that he had done to them in summer. The wolf struggled and escaped, but his tail was left in the frozen ice hole.

I read that a few times to get my head around the fairy tale. It didn’t make any sense given the context. I guess Putin wanted to give some folksy spin to his threat of freezing Europe this winter. Maybe Russians enjoyed that. Anyway, the upshot of this threat was visible in the meeting of the EU ministers on Friday that was convened to discuss the energy crisis. The ministers deferred the proposal to cap price agreeing that it needed more work and deliberation. Also, there was no real proposal to force a reduction in demand among the member countries. There is a voluntary pledge of cutting it by 15 percent but that might neither be enforced nor be adequate. I guess the price surge, if allowed, will eventually bring down the demand but which politician will want that scenario to be played out? That leaves the option of a combination of rationing for industries (less politically sensitive) and government subsidies to manage the pain for people. That’s what different governments have been doing. France, as NYT reports, has asked businesses to appoint an ‘ambassador of energy sobriety’ while spending over €26 billion since the Ukraine war to keep gas prices in check.

Further:

Germany, Europe’s biggest user of Russian gas, reversed plans on Monday to shut down two of its three remaining nuclear power plants by the end of the year, and on Sunday announced a $65 billion aid package to ease the burden of high energy costs on citizens. Italy is looking to Algeria as a potential new supplier of natural gas to replace Russian fuel. In Spain, the government has begun a huge effort to improve energy efficiency in buildings and in industry.

Also, it is not as if the utility companies are making money hand over fist at this time. All utilities companies use derivatives available on utility exchanges to protect themselves from price swings. Typically, they lock in a price for the future to guard themselves against price falling. When prices surge, like they have now, they cannot cancel these derivatives and this leads to huge losses at least on paper. Eventually, if the prices remain elevated and the derivatives contracts run out (usually 6-9 months), the utilities will make a windfall. But till then the exchanges are at risk that the utilities will not be able to honour their derivatives contracts. So, the exchanges will demand that utilities give them cash collaterals for such an eventuality. What could be the size of such collaterals put together? A reasonable estimate is about €1.5 trillion. There is no way that utilities are sitting on that kind of working capital to stump up this collateral. For the markets to function efficiently and to avoid a Lehmann-like contagion, some solution has to be found. One is to cap the price and prevent further paper losses. But Putin has closed that option. Eventually, the governments will have to step in as the back stop. There’s a lot of heavy lifting the governments have to do. It will further raise their debt burden that’s already at their peak after the spending spree during the pandemic. The taxpayers will have to foot the bill; one way or the other.

I don’t know about you but it doesn’t seem to me there are any good options left for Europe in the short run. Some kind of a structural solution can be worked out where the tariff deficit is allowed to be spread over a longer term, thus allowing the utility companies to securitize these future revenues. It is easier said than done though. The other scenario is for EU members to agree on price caps, Putin’s wrath notwithstanding. This will happen because humouring Putin isn’t a long term solution. That apart, there could be some forcible demand reduction, then a hope for a milder than usual winter and a scenario where there’s an increase in supply from the Middle-East and the US because of the likely move away to Russian oil and gas by China and India. A combination of all of these could help Europe tide this crisis over. It isn’t going to be easy at all.

Europe’s winter of discontent has begun. And it could be a long one.

Meanwhile, Europe isn’t alone in the energy crisis.

Here’s the Washington Post on China:

Amid the most intense global heat wave in decades, China experienced another electricity crisis this summer. Ten months after surging coal prices drove widespread curbs on power consumption, parts of central and eastern China had to ration power after months of drought and scorching heat.

This year’s heat wave across central and eastern China ran for more than 70 days, the country’s longest stretch since such record keeping began in 1961. Rainfall dropped more than 45 percent across the Yangtze River basin, which supplies water to more than 400 million people.

Supply constraints, in turn, forced severe restrictions on power use in Sichuan and other provinces that tap into Sichuan’s power. Sichuan authorities imposed comprehensive restrictions on industrial power consumption starting Aug. 15, while neighboring Chongqing, a provincial-level municipality with a population of 32 million, introduced similar cuts two days later. Additional restrictions for commercial spaces and households meant limited access to cooling, even when daytime highs exceeded 100 degrees Fahrenheit.

And China’s short term response won’t be music to the ears of the climate warriors:

Authorities are likely to respond by expanding their alternatives to hydropower. This may well include building more coal-fired power plants, which are responsible for roughly 40 percent of China’s carbon emissions. The 2021 crisis saw the same response; provincial coal-fired power plant approvals rose almost 50 percent year on year in the first half of 2022 as the central leadership stressed the importance of “energy security.”

Thankfully, India has seen through its summer months before the global energy crisis has come to a head. The global demand for coal has surged as countries have been forced to hark back to thermal power plants to meet their energy needs. Almost 70 percent of electricity generation in India is from thermal power plants. The domestic supply of coal isn’t going to be enough and Indian companies will need to stockpile more for future security. This is an area to keep an eye on while looking at the macroeconomic indicators for India that otherwise look benign in a troubled world.

Not(PolicyWTF): No Exports Without Imports

This section looks at egregious public policies. Policies that make you go: WTF, Did that really happen?

- Pranay Kotasthane

If one were to make a word cloud of our editions, the term “import substitution” would appear right in the centre, in angry red colour. On many occasions, we have highlighted that high import tariffs and Production Linked incentives (PLIs) are at cross purposes. The tariffs end up increasing input costs to such an extent that it negates the monetary benefits of PLI schemes. The result is that manufacturing in India remains as uncompetitive as it was earlier, despite the government providing significant financial incentives.

Given our abhorrence for higher tariff barriers, it was a welcome surprise that the Minister of State for Electronics and Information Technology released an excellent report on August 29th, which has empirical evidence on the importance of trade for creating a domestic electronics industry.

The report, titled Globalise to Localise: Exporting at Scale and Deepening the Ecosystem are Vital to Higher Domestic Value Addition in Electronics, is written by trade economists from Indian Council for Research on International Economic Relations (ICRIER). It makes a crucial point that should interest anyone interested in Indian public policy: India must first globalise and only then localise if it aspires to be a global production and export hub for electronics. I guess this recommendation would hold to a large extent in other sectors as well.

But let’s get back to electronics. The report highlights that both Viet Nam and India exported the same value of electronics items in 2010. But by 2020, Viet Nam’s electronics exports had become seven times that of India’s. What just happened?

The report argues that the reason could be the difference in trade strategies followed by Viet Nam and China on one hand, and by India on the other. The difference is this. Indian governments have pursued a strategy of simultaneously increasing electronics exports and boosting domestic value addition per unit of total demand. For increasing exports, governments used tax rebates and built special economic zones. For boosting domestic value addition, governments deployed higher custom duties for components, and local sourcing norms for public procurement.

In contrast, both Viet Nam and China focused on growing their exports at scale first. At first, this led to a decrease in the domestic value added per unit of demand. This is because companies preferred to import components, assemble, and then export them. Only after electronics exports had achieved global scale did the two countries target local content addition. That too, through instruments such as sourcing fairs and technology upgradation programmes, instead of erecting trade barriers. Over time, not only did the exports continue growing, but also a competitive components industry mushroomed.

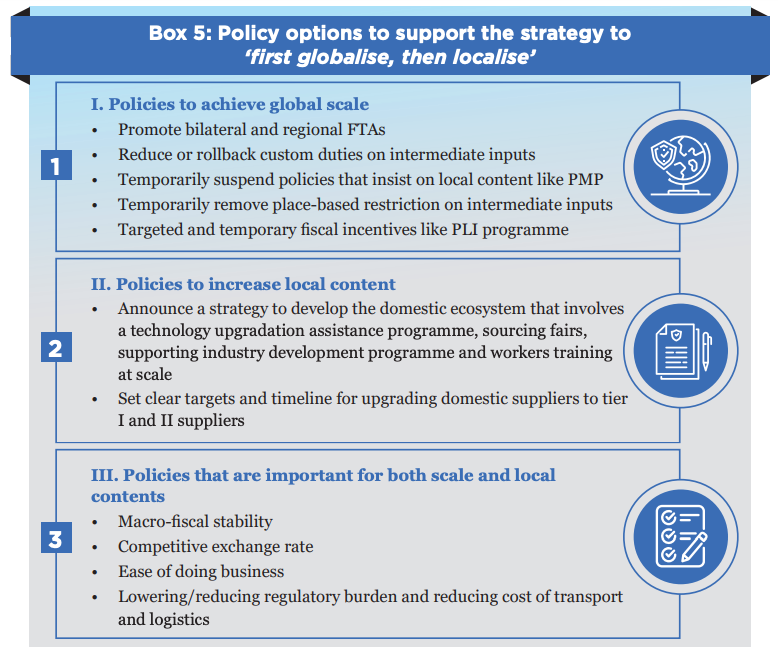

Hence the report suggests that India too should first globalise and then localise. The comparative analysis in the paper is illuminating. I’ll leave you with the recommendations chart, which has specific ideas for putting this strategy into effect.

From a political economy viewpoint, it’s interesting that the electronics ministry unveiled this report. I hope that it suggests that the government is willing to reconsider its strategy of high custom duties for domestic value addition. To become a global manufacturing hub, we need to internalise that import substitution is self-defeating.

PS: This report’s analysis also makes for an excellent public policy teaching resource.

India Policy Watch: Kaun Kitne Paani Mein?

Insights on topical policy issues in India

— RSJ

This week Bangalore had rains.

Tip tip barsaa paani.

And paani ne aag lagaa di.

Pictures of streets of Bangalore looking like a river in spate with high-end luxury cars drowning in them made the rounds. The poor took the usual brunt. The familiar lament of lack of urban planning, the venality of municipal corporations in big cities and the apathy of citizens soon followed. Such flooding is a common phenomenon now even in cities that don’t have a history of heavy rainfall. Over the past few years, there have been similar pictures from Chennai, Hyderabad and Pune.

There are four factors at play here.

First, there’s climate change. It could mean different things to different people. But let’s accept short bursts of intense and often unseasonal rainfall is a thing now in many parts of India and the world. It didn’t happen this often in the past. So, expect flooding when you get more than 150 mm of rainfall in under 3 hours in a densely populated urban landscape like it happened in Bangalore this week..

Second, urbanisation is good for India and it will only gather more pace. Cities provide network benefits, greater opportunities and they help diffuse historical identities that get in the way of social mobility. New cities or satellite towns cannot be planned and developed top down like many policy makers think when they announce such plans. So, there’s no point arguing for reducing the burden of a large city by proposing a plan to ‘develop’ new cities. A city emerges organically on the back of the millions of individual transactions that continue growing because of network effects. You cannot control them though you can anticipate their growth and plan to manage it. That planning is totally absent in India. The numerous cases of lake beds and natural reservoirs being usurped for construction, the lack of any thinking about the topography of a location and the flow of water in it before allowing for buildings to come up and consistent reduction in green cover - all of these mean there’s nowhere for water to go except flood homes and then stand still till it is pumped out.

That brings me to the third point. The way the political economy is structured right now, it is difficult to see how there will be enough devolution of power and finances to a city. A big city most often is a bankrupt political orphan in India. It doesn’t look like changing any time soon.

And lastly, you have to ask how long will citizens remain stoic and manage their lives through these great difficulties? Should we beware the fury of the patient?

Among these four, I don’t foresee any correction of course for the first three factors. They will continue in the same vein. That leaves only the citizen. She will have no choice but to accept these as inevitable and then find private solutions to what are public problems. These solutions will tend to be locally optimal but suboptimal for the whole. The numerous gated communities that try doing this are examples of this. You can live in a gated republic and keep the state away. But nature is a different ballgame. It doesn’t care for your gates. Things will only get worse for citizens.

Will there be a tipping point, I often ask myself? I don’t think so. People will grin and bear it. And then forget it.

Resilience of the people is the timeless safeguard against a revolution.

Matsyanyaaya: Chip Trouble

Big fish eating small fish = Foreign Policy in action

— Pranay Kotasthane

In a Politico article earlier this week, the authors explain Russia's desperate attempts to get hold of some pretty basic integrated circuits (chips) for military equipment. This news comes closely after the delays in delivering frigates to Indian Navy. The Indian government would do well to keep a close eye on these developments.

Regardless of Russia's intent, its defence production competence has been set back many years because of the coordinates sanctions. This means India should develop contingency plans for all pending military platform deliveries from Russia.

Russia doesn't have reliable semiconductor manufacturing facilities of its own. We should expect that it will try to get hold of these legacy-node chips through the black market. We should also expect that some Chinese foundries like SMIC might come to Russia's rescue. In either case, it has the same lesson for India - Russia's ability to deliver secure military platforms to India has taken a big hit. We should seek other alternatives.

HomeWork

Reading and listening recommendations on public policy matters

[Article] This post by Hannah Ritchie on effective but counter-intuitive ideas on climate change action is gold.

[Book] This excellent book, Global Value Chains and the Missing Links Cases from Indian Industry by Saon Ray and Smita Miglani

[Article] S Vishwanath has the most informative article on the Bengaluru floods.

Share this post