#301 Stumbling Blocks

Retrospective Insolvency, Making Federalism Cooperative for Real, A Bizarre Court Order, and a Record RBI Dividend

India Policy Watch #1: Won’t Let You Down

Insights on current policy issues in India

—RSJ

As expected, the RBI declared a record dividend payout of ₹2.69 trillion to the government of India (GoI) for FY26, primarily driven by gross dollar sales, forex gains, and an increase in interest income that it earns from lending to the banking system. As I have written in previous editions, the central bank has been proactive and aggressive in stabilising the rupee over the last 12 months. This meant a record dollar sales of around $370 billion during FY25. Most of these dollar reserves were built up when the dollar was pegged much lower to the rupee than it is now. That difference, or forex gains, is the bulk of the surplus for the RBI. With this payout, GoI has received about ₹0.4 tn above the FY26 budget estimate, a nice cushion to have early on in the year.

The usual question to ask at this moment is if this windfall has been passed on at the expense of strengthening the RBI balance sheet with a buffer for managing volatility in future. This is why back in 2018-19, the Bimal Jalan committee was set up to create a framework for RBI’s surplus distribution with a clear definition of Contingent Risk Buffer (CRB) and the range within which the RBI must operate. This economic capital framework was set up, which then mandated that the CRB be maintained in the 5.5-6.5% range. Any surplus transfer to the GoI should not breach the lower threshold of this range.

The short answer to that question is no, the RBI hasn’t compromised on stability at all. The RBI announced a revised economic capital framework with the CRB range widened to 4.5-7.5% in view of the increased global economic and political uncertainty. The CRB for FY25, after accounting for the dividend paid out, comes at 7.5%, the top end of the range. Had the RBI decided to stick to its old upper limit of 6.5%, it would have had an additional ₹0.7 tn to pay to the GoI. That the GoI didn’t nudge the RBI for this additional windfall is a prudent call that should be appreciated. If I were to project forward, the growing size of the RBI balance sheet and likely higher yields, it will be safe to assume more than ₹2 tn payouts for the next two years as well. I would assume this surplus of ₹0.4 tn over budget estimates this FY and possibly a similar quantum in the next two years should help keep the fiscal deficit forecast trend line on track, despite an increase in defence spending that’s inevitable post Operation Sindoor. Simultaneously, this surplus transfer will add further to system liquidity, which was a constraint for most of FY25 and had led to a sharp decline in credit growth.

Another question that comes up whenever the RBI declares a seigniorage income, like it did last week, is how other central banks are doing on this metric. Well, not so great if you look at the US Fed’s balance sheet. Banks have continued to hold higher reserves with the Fed than needed, and in a high-interest regime prevailing since 2023, the Fed pays for these liabilities more than it used to earlier. The seigniorage the Fed makes by issuing dollars as cash (printing money) is also coming down as cash usage declines. The Trump administration's unusual bullishness on private stablecoins will further reduce the demand for cash. The seigniorage income will only see a secular decline over the years given these trends. The upshot of all of this is that the Fed actually made a loss of $78 bn in 2024 (they made a loss in 2023 also). So, the Fed hasn’t paid any dividend to the Treasury for the past two years. Rather, it is booking these losses as deferred assets with the hope of reversing them in future when the interest rate cycle starts going down. With Trump at loggerheads with Jay Powell on rate cuts, these losses at the Fed, instead of the usual dividend, won’t do much for the Fed’s independence in this regime. There are days India looks like a more mature democracy than the US.

India Policy Watch #2: The Ghosts Of Bhoot Kaal

Insights on current policy issues in India

—RSJ

There’s that famous quip of the former RBI Governor, Y.V. Reddy: “elsewhere in the world, the future is uncertain. In India, even the past is uncertain.”

We have had two fine examples of this in the past couple of months.

On Feb 28, 2025, the NSO released the First Revised Estimate (FRE) of GDP for 2023-24. This estimate showed the GDP growth for 2023-24 was at 9.2 per cent, up from 8.2 per cent, which was the provisional estimate released in May ‘24. If we were to go back a bit further, the First Advance Estimate (FAE) that was published in Jan ‘24 was about 7.3 per cent. Over a year, the GDP growth estimate for 2023-24 has increased from 7.3 to 9.2 per cent. We will have to wait and see what the Second Revised Estimate (SRE) comes up with, which will be the final official number for 2023-24. Going by the trend, I won’t be surprised if we end up with a double-digit GDP growth in 2023-24, something none of us divined we were living through. Going back, similar upward revisions were also done for 2022-23, where we had certain segments move from a degrowth of 1 per cent in the first estimate to a growth of 10 per cent in the second. While minor changes and adjustments are expected as better data comes through over the course of the iterations, it is difficult to imagine what explains such wide swings or large adjustments to the overall GDP numbers. The credibility of our data and the quality of policy-making are compromised because of this.

The other remarkable example in a similar vein came earlier this month from the Supreme Court. It struck down JSW Steel’s buyout of Bhushan Power & Steel (BPSL) after four years of the transaction being completed and rejected the insolvency plan that was executed under the Insolvency and Bankruptcy Code (IBC) based on an appeal filed by the promoters and operational creditors of BPSL. The Supreme Court also ordered that payments made by JSW to financial creditors and operational creditors and towards equity contribution (after BPSL was successfully acquired by JSW under the aegis of the corporate insolvency resolution process (CIRP) under the IBC in 2022) are required to be returned within two months from the date of the Judgment.

Some context here. BSPL was among the ‘dirty dozen’ list of stressed assets identified by the RBI for insolvency resolution under the new IBC law back in 2017. JSW was one of the bidders for the asset. After multiple twists and turns, including cameo appearances by that versatile character actor, the Enforcement Directorate (ED), the Committee of Creditors (CoC) and JSW finalised the deal in 2021. JSW agreed on three key elements of the resolution plan: i) equity infusion of INR 100 crore in BPSL; (ii) payment of approximately ₹19,350 crore to financial creditors of BPSL; and (iii) payment of approximately ₹350 crore to operational creditors of BPSL. All these were done, and Bhushan has been running as a unit of JSW and contributing to about 15 per cent of its production capacity. Now, almost three years after all of this was done and dusted, the Supreme Court has rejected the resolution plan and asked JSW to roll the clock back to 2017. This was on the basis that JSW did not strictly comply with the requirements under the IBC. The Supreme Court also observed that the resolution professional of BPSL did not duly discharge his duties under the IBC and that the CoC has failed to exercise its commercial wisdom in terms of approving a Resolution Plan which was in contravention of the IBC. BPSL will, therefore, have to be hived off from JSW and all payments made by JSW to financial creditors and operational creditors, and towards equity contribution are required to be returned within two months from the date of the Judgment. This is a huge blow to JSW’s ongoing business, as all its investment in BPSL to turn around the business will likely be a sunk cost. This is in addition to the potential loss of synergies and cost optimisation that JSW would have received from its investment in BPSL. This is also a nasty surprise to banks (largely state-owned banks), who will have to return the money to JSW, which has been accounted for as recoveries in their P&L over the years. It is hard to see who the judgment benefits except for the original promoters of BSPL. JSW plans to appeal for a review of the judgment.

So, what we have here is a good case of IBC process working that led to recovery of value for the creditors, revival of a debt-laden sick industry in an important sector by a competent acquirer that made significant investments and a thriving production setup that generated jobs in a neglected region of eastern India. But that’s all history now with this unwinding order. What confidence will future bidders and investors have in participating in an IBC process if, four years later and after a significant turnaround, you could have it all taken away from you? We are back in that dreaded retrospective tax zone.

Businesses prepare for an uncertain future. An uncertain past is just too strong an adversary.

India Policy Watch #3: What Does it Take to Create a Team India?

Insights on current policy issues in India

—Pranay Kotasthane

Several developments took place this week concerning union-centre relations. One, the Tamil Nadu government sued the Union government in the Supreme Court for withholding over ₹2000 crores under the Samagra Shiksha Scheme. Tamil Nadu charged that the Union government was surreptitiously linking the implementation of the “three-language formula” in select schools to the disbursement of education funds. Two, the NITI Aayog chaired its tenth governing council meeting. In the absence of the Planning Commission and the complete neglect of the Inter-State Council, this is the only platform where all the CMs, the PM, and Union ministers meet each other. Three, another round of language-related kerfuffle became national news. This time, the Karnataka CM and several other political leaders got involved and gave the incident more attention than it deserved. All war-generated national integration quickly evaporated and was displaced by the generic north-south flame wars.

All these instances highlight yet again that cooperative federalism is merely a nice-sounding idea. The NITI Aayog Governing Council, which is convened once a year, is not enough to make cooperative federalism a reality. While the PM stressed the idea of Team India to realise the goal of Viksit Bharat 2047, working together requires a serious investment in institutions, not platitudes.

Here are four such ideas worth considering.

1. An institution for vertical and horizontal bargaining

This idea comes from Dr Govinda Rao. He writes in his recent book, Studies of Indian Public Finance, that India lacks an institution that can act as a credible umpire between various states, and between the states as a whole on one side and the union government on the other. The National Development Council, created for this purpose, is defunct, the Inter-State Council is a part of the union government, the Rajya Sabha is no longer the Council of States in reality, and the finance commissions are dissolved after making their recommendations. The result is that no institution can truly champion cooperative federalism. The GST Council perhaps acts as a bargaining and negotiation platform in the limited area of indirect taxation. A meta-institution dedicated to horizontal and vertical balance is imperative to manage India's heterogeneity. NITI Aayog thus far hasn’t been able to fill the Planning Commission’s shoes in this regard, and is seen by states as an institution acting in the interests of the Union government.

2. Increase vertical devolution of shared resources from 41% to 50%

The TN government’s petition against the Union government for non-disbursal of funds under the Samagra Shiksha Abhiyaan has broader implications beyond who wins this case. It is an opportunity to increase vertical devolution to states. As long as there are centrally sponsored schemes, which are designed by Union line ministries and only implemented by states, the Union government is within its rights to change the scheme's design. States must demand that grand schemes falling under the State and Concurrent Lists be scrapped and that they receive untied funds instead. This way, states can decide their priorities while the Union can focus on a select few centrally sponsored schemes, mainly focused on states that need its help. Thankfully, this point was raised by the TN CM at the NITI Aayog meet as well.

3. All-party delegations visiting different states

Another idea comes from India’s all-party delegations meant for global outreach regarding the actions it took against Pakistan after the Pahalgam terrorist attack. Similarly, we need a domestic mechanism where states send delegations to other states explaining their visions for development and growth. As the recurring language wars illustrate, inter-state trust levels are dropping. Lok Sabha seat reapportionment stemming from delimitation; charges of unfair fiscal redistribution; and the insider-outsider debates sparked by local reservations will only worsen the situation. Debates on these sensitive issues are only happening in the gladiatorial arena of social media, where extreme views get disproportionately rewarded with more engagement. Thus, we need systematic interactions to tackle mistrust and misconceptions. State delegations representing political parties, businesses, and other sections of society visiting different states explaining their approach on development challenges and efforts could perhaps bridge the gap. National integration cannot be imposed, but will grow out of mutual understanding.

4. Union-state sub-groups for Viksit Bharat 2047

Another interesting idea comes from the Andhra Pradesh CM, who proposed three sub-groups at NITI Aayog on GDP growth, population management, and leveraging Artificial Intelligence (AI). While I don’t agree with these themes, the idea of sub-groups involving representation from a few states and the Union government is worth considering. This approach could allow states to partner with each other and with the Union government.

Without these institutional mechanisms, cooperative federalism will continue to be a slogan. After all, creating Team India ain’t easy.

India Policy Watch #4: Supreme Waffle

Insights on current policy issues in India

—Pranay Kotasthane

The Supreme Court has been having a rough time lately. RSJ has already described how its retrospective insolvency judgment could adversely impact India’s economic prospects. Earlier this week, it came under heavy criticism for an overly restrictive bail order and its decision to outsource the analysis of a university professor's simple social media post to a Special Investigative Team of police officers.

Not only did the judges not dismiss the case, but they also pontificated on the need to balance rights with duties, and threatened that they knew how to deal with protesting students and professors opposing the professor’s arrest.

Further, the bail order bans the defendant from commenting on the India-Pakistan conflict and orders him to surrender his passport. In his Hindustan Times column, Gautam Bhatia describes why such a legal position is problematic:

“… it is important to point out that the judiciary does not have the power to gag or silence someone; it is only empowered to determine whether the government’s decision to do so is constitutional or unconstitutional. Here again, we see a judicially imposed gag order that is not backed up by legal reasoning. Instead of indicating what, in Mahmudabad’s post, potentially breached the law, the Court left this issue to be addressed subsequently by the SIT — but in the meantime, gagged Mahmudabad in any case.” [Gautam Bhatia, Hindustan Times, May 22]

The second substantive issue raised by this case was whether the fundamental right to freedom of expression included the freedom to be unpatriotic. As we have discussed in a previous edition, there is a vast difference in what constitutes anti-government, anti-national, and anti-State. In dictatorships and party-states, the charge of sedition is applied wantonly to criticisms of the government. That is, being anti-government itself is seen as being anti-national, and hence anti-State. In most modern democracies, however, sedition laws punish only those anti-State actions which can challenge the State’s authority directly. Thus, criticism of the Republic of India would not count as sedition, but inciting violence against the police would count as sedition. Crucially, the Republic should also protect a citizen’s right to express anti-national thoughts as long as they don’t cause any violence or disorder.

Nevertheless, courts increasingly conflate anti-national and anti-government acts with anti-State ones, which is a dangerous sign for the republic. Pratap Bhanu Mehta explains this in his Indian Express column with characteristic clarity:

“It is a platitude that there is no such thing as absolute free speech. But the restrictions on speech have to be, even in Indian law, very narrowly tailored to things such as very evident incitement and disruption of public order. Two, shifts in legal culture are dangerous — they have enabled the requirement that free speech is only for “virtuous” speech. This is not the occasion to litigate the merits of Khan’s post. The issue is not his merit, but his rights. As a matter of debate, in the public sphere, people may very well judge these posts to be ill-advised or unpatriotic. It is their right to do so. But as a constitutional and legal matter, it ought to be worrying when plaintiffs are almost forced to prove that their speech has patriotic merit. In fact, there is no bigger dog whistle than the state looking for patriotic merit in speech and for every citizen to prove that they are patriotic. For one thing, patriotism is a nebulous object. Who sets the standard? Under current standards, I am pretty sure Mahatma Gandhi, Jawaharlal Nehru, and possibly even B R Ambedkar would have, at various moments, been deemed unpatriotic. In some ways, by shifting the terrain to patriotism, the Court is, consciously or unconsciously, legitimising an ideology, not protecting speech or liberty. It is not the Court’s job to be the schoolmaster of patriotism.” [Pratap Bhanu Mehta, Indian Express]

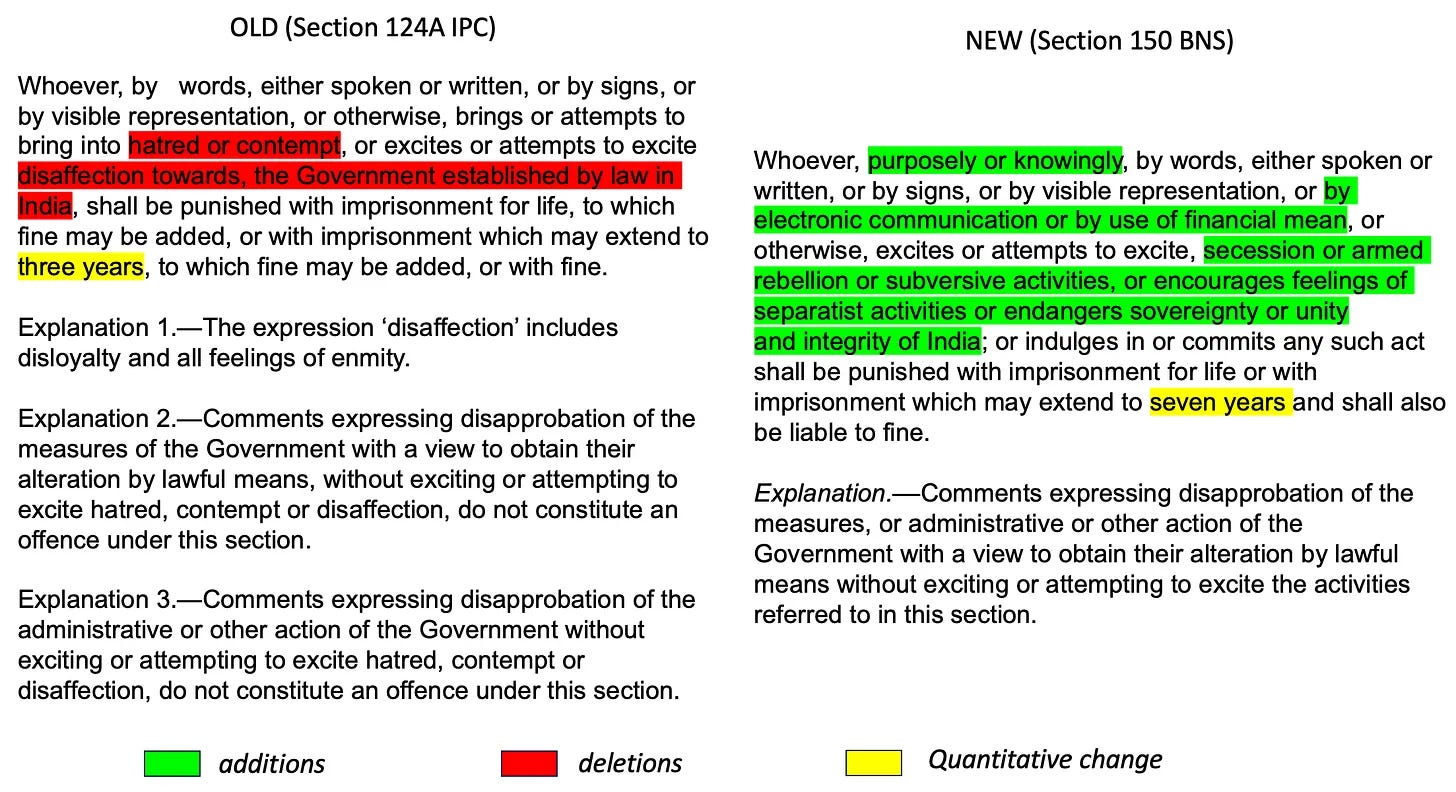

The new penal code further complicates the issue. As we explained in edition #223, the Bhartiya Nyaya Sanhita Section 152 is even more expansive than the sedition law it replaced, because it explicitly adds a new dimension of proscribing the “encouragement of feelings of separatist activities”. Dissent is not adequately protected, and most likely, this section violates Article 19, which gives the fundamental right of freedom of expression unless it threatens the State or law and order.

Perhaps, it’s time that the Supreme Court take heed from an order passed by the District Court of Delhi in the Disha Ravi #Toolkit case, where it observed:

“Citizens are conscience keepers of government in any democratic Nation. They cannot be put behind the bars simply because they choose to disagree with the State policies. The offence of sedition cannot be invoked to minister to the wounded vanity of the governments. Difference of opinion, disagreement, divergence, dissent, or for that matter, even disapprobation, are recognised legitimate tools to infuse objectivity in state policies. An aware and assertive citizenry, in contradistinction with an indifferent or docile citizenry, is indisputably a sign of a healthy and vibrant democracy.”

HomeWork

Reading and listening recommendations on public policy matters

[Article] A post by Takshashila’s high-tech geopolitics team on What the Repeal of the US AI Diffusion Framework Means for India and the World.

[Post] Urbanomics has a good post on Deregulation is rarely a stroke-of-pen reform. This adds to the idea of a Regulatory Responsibility Act, something we discussed in edition #297.

[Podcast] The latest The Seen and the Unseen episode is on the tactical, operational, and strategic implications of Operation Sindoor.

What a treat to read this news letter. For me it even more enjoyable because I can relate to what I learnt in GCPP class -

1. Numbers are ambiguous and politicians use number to exploit us - 2023 GDP numbers.

2. states clarifying their vision for growth and development should be given priority to further cooperative federalism.

3. Anti-state is different from anti-government.

4. Recent case of professor being jailed is the case for judicial overreach. Govt is temporary and state is permanent. Ridicule of govt policy is not being seditious, rather it is our right to question and be critical of Govt action.

5. Govt job is to provide conducive environment for businesses to prosper and not to resort to retrospective tax.

'The seigniorage the Fed makes by issuing dollars as cash (printing money) is also coming down as cash usage declines' -

Seigniorage is earned even when Fed or any central bank issues currency in digital form and maybe more than what it earns from physical cash as it is costlier printing cash with all the security features, security paper, specialised printing equipment and so on. When a central bank credits a commercial bank's account with it for, say a purchase of securities under open market operations, seigniorage earned per unit of currency is more, than paying it cash